August 14, 2019

Default Manager, Risk Manager, Operations, Due Diligence, Servicing4 Strategies Servicers Can Utilize to Keep Default Rates Low

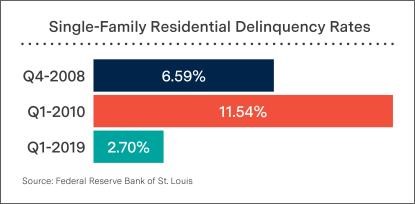

Mortgage loan default and delinquency rates remain at historic lows. In fact, the 4.42% share of US homeowners who were late paying mortgages in the first quarter of 2019 was the fourth lowest on record, according to the Mortgage Bankers Association.

The mortgage industry has made great strides since the crisis—investing in technology, enhancing existing tools and platforms, and increasing communication efforts to fortify sound, practical residential loan servicing practices to help better manage risk, maximize cash flow, and minimize defaults. These efforts have been deliberate and specific, focusing on early intervention and better ways to leverage technology in the process.

The evolution of these practices is ongoing. Today, banks and mortgage servicers are faced with a landscape characterized by changing regulations and increasing investor demands for transparency and accountability. So how can servicers continue to keep default rates low?

1. Leveraging Automation

Automated technologies can spot changes in loan and transaction performance sooner, ultimately providing earlier intervention for proper issue resolution and risk avoidance. Risk surveillance analysts use these technology platforms to monitor a breadth of mortgage activity and identify potential problems and risks before they happen. Providing this key information at the forefront of the process has been a major contributor to the decline in default rates.

These technologies are proactively becoming the kick-off to default communications that help loan servicers to—in real time—mitigate loss severity, increase return on investment (ROI), and strengthen the value of a loan portfolio.

Automated technology is also arming surveillance professionals with analytics and reporting. Some of these technologies create summary dashboards and scorecards focused on data such as delinquencies, losses and severities, prepayment speeds, default timelines, value declines, and analyst watch lists.

2. Improving Communication

Today, nearly all communication has gone digital, with borrowers managing much of their communication on their computers, smartphones, and tablets. They expect notifications about their loan in real-time, not via snail mail.

Better communication between servicers and borrowers has also allowed for faster application processing. Today, applications are being processed and decisions are being made within as little as five days. Borrowers are no longer reduced to waiting around to find out their next steps and are moving forward through the remediation process at a faster pace.

Not only is communication with the borrower key, it is important to have streamlined communication between lenders and servicers. Due to new regulations and checks-and-balances, innovations in database technology are now enhancing communication among lenders and servicers, enabling them to obtain, store and transfer data effectively and easily with each other.

3. Early Intervention

Automated surveillance and improved communication methods are making it possible for servicers to intervene as soon as a risk is identified. Servicers are able to contact borrowers using several communication channels to alert them that there is a risk of default.

A key part of this early intervention plan is to offer support and assistance by providing borrowers with their available options. Whether they opt for short-term forbearance, loss mitigation, a short sale, or anything else available to them, borrowers can choose the option that works best for their circumstances.

4. Embracing Regulation

One of the major post-crisis changes from the Consumer Financial Protection Bureau (CFPB) is the mandate to provide clearer messaging. Evidence suggests that the CFPB rules have successfully kept mortgage delinquency rates down and borrowers out of the hole.

One factor contributing to this lower rate is the CFPB requirement for servicers to provide borrowers with information about available loss mitigation options to avoid foreclosure. Servicers can continue to help their borrowers by embracing the guidance from this regulation—whatever the regulatory future holds—and providing clear information and resources to their borrowers.

Conclusion

Higher consumer financial confidence, historically low unemployment rates, and technology that improves monitoring and communication are all creating a historic opportunity to maintain low default rates for the foreseeable future. Of course, this will still require servicer vigilance and the willingness of all parties to communicate openly and transparently in order to eliminate the chances of returning to the high-risk era of a decade ago.

Help Safeguard Property Transactions: A Deep Dive into Seller Impersonation Fraud

Understand the threat of seller impersonation fraud in real estate transactions. Help safeguard against these fraudulent activities by learning how scammers may use sophisticated methods to impersonate property owners and steal sale proceeds, warning signs to watch for, and potential protective measures including thorough identity verification, title insurance, and settlement services.

Single-Family Rental Market Insights: What Investors Need to Know for 2025

The recent IMN Single-Family Rental (SFR) West Forum in Scottsdale, Arizona provided valuable perspectives on the current and future state of the SFR market. Industry leaders shared compelling insights that demonstrate the resilience and evolving nature of this space.

Beyond the Rate Drop: Helping to Future-Proof Your Lending Strategy

The recent drop in interest rates may lead to an influx of purchase and refi volume for lenders. With this shift on the horizon, learn more about positioning yourself to meet customer needs and help borrowers at scale through proper use of technology and innovative solutions.

Homebuying Trends in the United States

Discover the state of homeownership in the US, including the significant disparities across racial and ethnic lines and the challenges that homebuyers face. Learn about the importance of addressing these disparities and creating more equitable pathways to homeownership for building wealth and ensuring accessibility for all.

Debunking 7 Common Mortgage Myths

The homebuying process can be exciting, but it can also be overwhelming, especially when it comes to mortgages. There's a lot of information out there, but not all of it is accurate. In this article, we debunk some common mortgage and PMI myths to help borrowers make better informed financial decisions.

Explore the Evolving Traits of First-Time Homebuyers

Our infographic explores the characteristics and behaviors of today's first-time homebuyers, who prioritize homeownership as an important part of the American Dream despite economic and societal changes.

Loan Officers' Social Media Checklist: Best Practices to Help Build Your Brand

Loan officers can benefit from social media to connect with potential borrowers, build their brand, and establish themselves as a reliable authority in the mortgage industry. Optimizing social media profiles and posting strategies can attract new business and create lasting relationships with borrowers and business professionals. Check out our checklists to get started!

5 Tips for REO Disaster Planning

Read about preventative measures you can take to minimize damage and recover quickly when a natural disaster impacts your properties.

4 Simple Steps for Loan Officers to Build Lasting Relationships in 2024

Using these 4 Simple Steps, Loan Officers can help their elevate business and redefine success in 2024 by building strong relationships with real estate agents, prior clients, local community organizations, and other trusted service providers.

Radian Launched Affordable Housing Crisis White Paper

Learn more about how increasing mortgage rates, skyrocketing home costs, and a lack of supply in the market have left many wondering if they will ever be able to afford a home.