December 13, 2019

Loan Officer, OriginationFour Reasons to Buy a Home Now

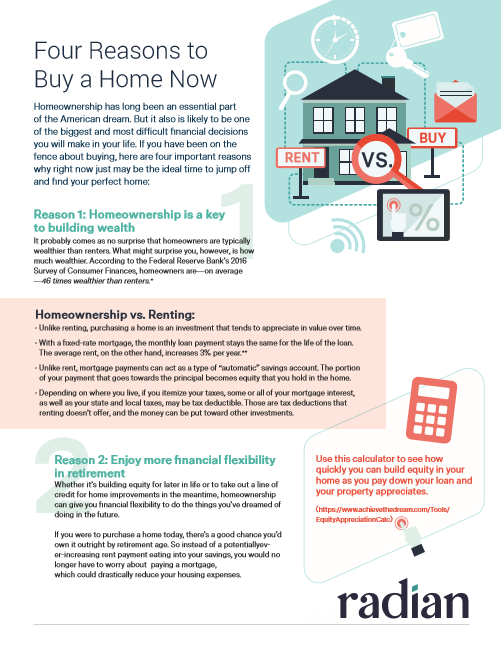

Homeownership has long been an essential part of the American dream. But it also is likely to be one of the biggest and most difficult financial decisions a person will make in their life. Here are four important reasons why right now may be the ideal time to buy. In addition, be sure to download and share the piece below.

Reason 1: Homeownership is a key to building wealth

According to the Federal Reserve Bank’s 2016 Survey of Consumer Finances, homeowners are—on average—46 times wealthier than renters.*

Reason 2: Enjoy more financial flexibility in retirement

Whether it’s building equity for later in life or to take out a line of credit for home improvements in the meantime, homeownership can give borrowers financial flexibility.

Reason 3: You do not need a 20% down payment

One of the biggest myths first-time home buyers encounter is that a 20% down payment is required. In reality, by taking advantage of PMI, borrowers can lock in historically low interest rates with a down payment as low as 3%.

Reason 4: There's never been a better time

Interest rates, currently down almost 40% from their post-housing bubble high of 6.48% in 2008, are at historic lows.

*Source: federalreserve.gov. https://www.federalreserve.gov/econres/scfindex.htm

4 Reasons to Buy a Home Now Infographic

Mortgage Insurance Premiums are Tax-Deductible: What it Means for Borrowers

Mortgage insurance (MI) premiums are once again tax-deductible, and this time, the benefit is here indefinitely. Learn more about what that means for borrowers and loan officers.

Navigating the Spring Market: Tips for Buying or Selling Your Home

Spring is the busiest season in real estate, with warmer weather and blooming flowers highlighting a property's best features, and buyers prioritizing home tours before family obligations. Take a look at our checklists to help buyers and sellers prepare for the upcoming busy market.

Why Buying a Home Still Makes Sense in Today's Market: A 2025 Perspective

In today's real estate landscape, potential homebuyers might hesitate to enter the market. However, despite current challenges, several compelling reasons make homeownership an attractive option. With proper planning and understanding of available options, buying a home in 2025 can be a smart investment in your future.

Beyond the Rate Drop: Helping to Future-Proof Your Lending Strategy

The recent drop in interest rates may lead to an influx of purchase and refi volume for lenders. With this shift on the horizon, learn more about positioning yourself to meet customer needs and help borrowers at scale through proper use of technology and innovative solutions.

Homebuying Trends in the United States

Discover the state of homeownership in the US, including the significant disparities across racial and ethnic lines and the challenges that homebuyers face. Learn about the importance of addressing these disparities and creating more equitable pathways to homeownership for building wealth and ensuring accessibility for all.

Debunking 7 Common Mortgage Myths

The homebuying process can be exciting, but it can also be overwhelming, especially when it comes to mortgages. There's a lot of information out there, but not all of it is accurate. In this article, we debunk some common mortgage and PMI myths to help borrowers make better informed financial decisions.

Explore the Evolving Traits of First-Time Homebuyers

Our infographic explores the characteristics and behaviors of today's first-time homebuyers, who prioritize homeownership as an important part of the American Dream despite economic and societal changes.

Loan Officers' Social Media Checklist: Best Practices to Help Build Your Brand

Loan officers can benefit from social media to connect with potential borrowers, build their brand, and establish themselves as a reliable authority in the mortgage industry. Optimizing social media profiles and posting strategies can attract new business and create lasting relationships with borrowers and business professionals. Check out our checklists to get started!

The American Dream of Homeownership Starts with Financial Literacy

As we celebrate National Financial Literacy month this April, it’s a reminder of the important role that financial literacy plays in preparing for the homebuying journey. Learn more about financial literacy for homebuyers.

4 Simple Steps for Loan Officers to Build Lasting Relationships in 2024

Using these 4 Simple Steps, Loan Officers can help their elevate business and redefine success in 2024 by building strong relationships with real estate agents, prior clients, local community organizations, and other trusted service providers.