November 16, 2023

Loan Officer, Mortgage Insurance, Industry News, OriginationThe Millennial and Gen Z Homebuyer

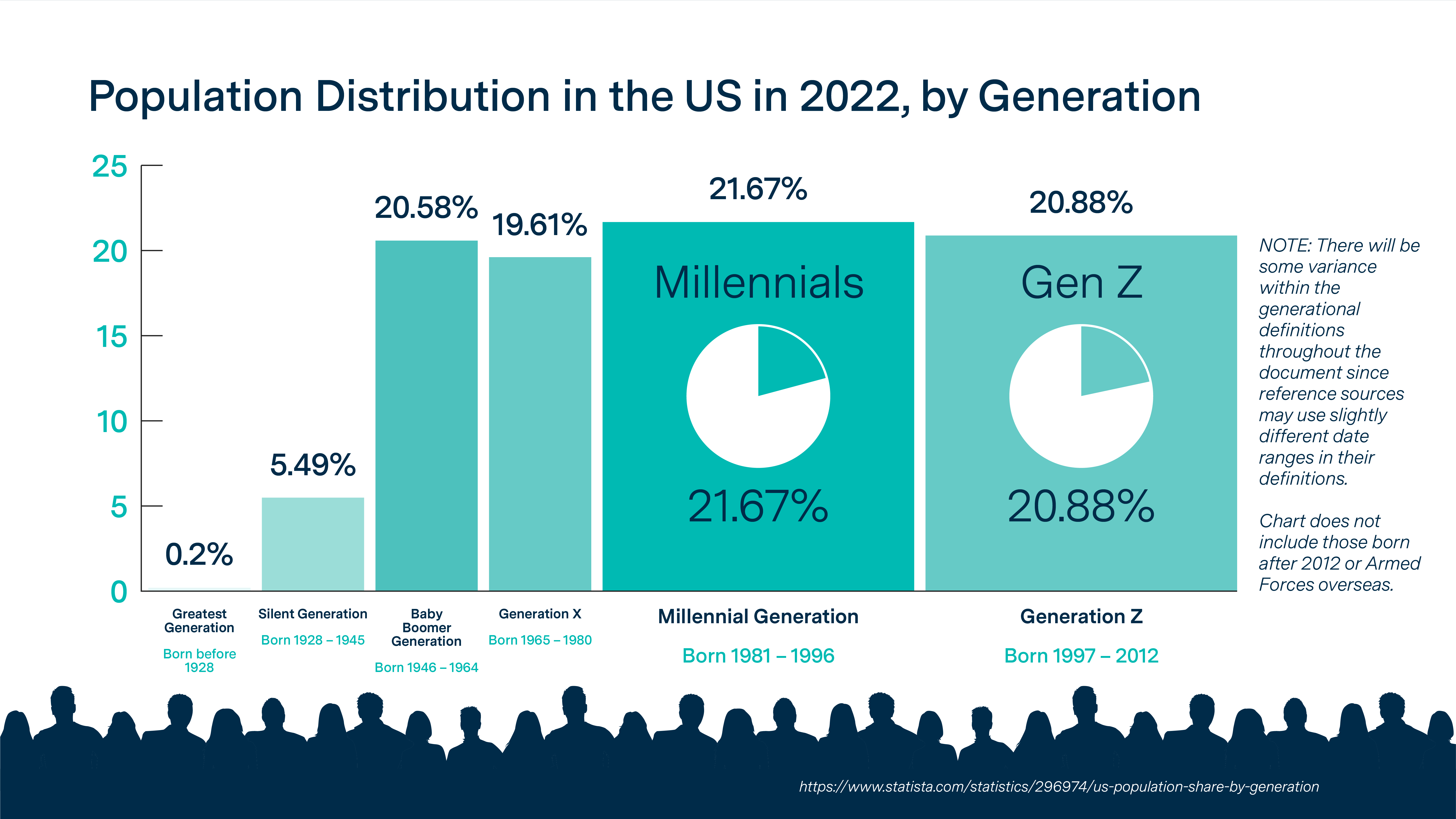

Recent years have seen substantial changes in the real estate scene, largely influenced by the Millennial and Gen Z generations. Recognizing and understanding their behaviors can empower both loan officers and real estate agents to make well-informed decisions on effectively engaging these distinct generations of homebuyers.

Mortgage Insurance Premiums are Tax-Deductible: What it Means for Borrowers

Mortgage insurance (MI) premiums are once again tax-deductible, and this time, the benefit is here indefinitely. Learn more about what that means for borrowers and loan officers.

Navigating the Spring Market: Tips for Buying or Selling Your Home

Spring is the busiest season in real estate, with warmer weather and blooming flowers highlighting a property's best features, and buyers prioritizing home tours before family obligations. Take a look at our checklists to help buyers and sellers prepare for the upcoming busy market.

Why Buying a Home Still Makes Sense in Today's Market: A 2025 Perspective

In today's real estate landscape, potential homebuyers might hesitate to enter the market. However, despite current challenges, several compelling reasons make homeownership an attractive option. With proper planning and understanding of available options, buying a home in 2025 can be a smart investment in your future.

Help Safeguard Property Transactions: A Deep Dive into Seller Impersonation Fraud

Understand the threat of seller impersonation fraud in real estate transactions. Help safeguard against these fraudulent activities by learning how scammers may use sophisticated methods to impersonate property owners and steal sale proceeds, warning signs to watch for, and potential protective measures including thorough identity verification, title insurance, and settlement services.

Housing Valuation Panel Recap: Is it Time to Sell or Can Values Rise?

In the ever-evolving real estate market, insights from industry leaders can help provide valuable insights for investors.

Single-Family Rental Market Insights: What Investors Need to Know for 2025

The recent IMN Single-Family Rental (SFR) West Forum in Scottsdale, Arizona provided valuable perspectives on the current and future state of the SFR market. Industry leaders shared compelling insights that demonstrate the resilience and evolving nature of this space.

Beyond the Rate Drop: Helping to Future-Proof Your Lending Strategy

The recent drop in interest rates may lead to an influx of purchase and refi volume for lenders. With this shift on the horizon, learn more about positioning yourself to meet customer needs and help borrowers at scale through proper use of technology and innovative solutions.

Homebuying Trends in the United States

Discover the state of homeownership in the US, including the significant disparities across racial and ethnic lines and the challenges that homebuyers face. Learn about the importance of addressing these disparities and creating more equitable pathways to homeownership for building wealth and ensuring accessibility for all.

Debunking 7 Common Mortgage Myths

The homebuying process can be exciting, but it can also be overwhelming, especially when it comes to mortgages. There's a lot of information out there, but not all of it is accurate. In this article, we debunk some common mortgage and PMI myths to help borrowers make better informed financial decisions.

Explore the Evolving Traits of First-Time Homebuyers

Our infographic explores the characteristics and behaviors of today's first-time homebuyers, who prioritize homeownership as an important part of the American Dream despite economic and societal changes.