November 17, 2019

Loan Officer, OriginationTop 5 Misconceptions Keeping Millennials from Homeownership

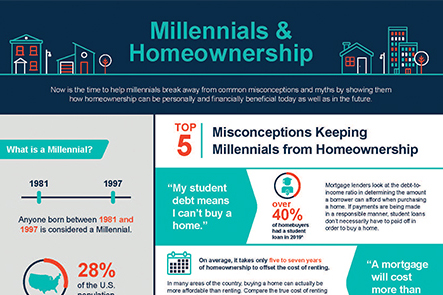

At 92 million people strong, Millennials, or men and women born between 1981 and 1997, make up 28% of the total U.S. population. Yet surprisingly, only 32% own a home (as compared with 60% for Gen X and 75% for Baby Boomers). Despite this fact, 93% of Millennials say they want to own a home in the future.

So why, then, is America’s largest living generation buying homes at a slower rate than in decades past? As it turns out, much of the problem can be attributed to a variety of misunderstandings and misconceptions Millennials have in regard to homeownership.

The good news is that many of the perceived obstacles discouraging Millennials from purchasing a home can be easily addressed with the help of an experienced lender armed with the right information and guidance.

Why Millennials are delaying making the leap to homeownership:

1. "My student debt means I can't buy a home"

In 2019, over 40% of all homebuyers had a student loan.* Mortgage lenders look at the debt-to-income ratio, or how much income is earned each month compared to what’s owed in student loans, car payments, credit card charges, etc., in determining the amount a borrower can afford when purchasing a home. If payments are being made in a responsible manner, student loans don’t necessarily have to be paid off in order to buy a home.2. "A mortgage will cost more than my rent"

In many areas of the country, buying a home can actually be more affordable than renting. What’s more, on average, it takes only five to seven years of homeownership to offset the cost of renting — in some locations, as little as 1 year. Here is a calculator to share with your buyers to help them compare the true cost of renting versus owning and explain to them why buying is a better way to achieve a financially secure future: https://www.achievethedream.com/Tools/RentVsBuy3. "I don't have a 20% down payment"

While the 20% down payment is considered standard, it’s not necessarily the only option. In fact, homebuyers may qualify for a multitude of low- and no-down-payment mortgage programs. And these programs aren’t just for first-time buyers, either. Repeat homebuyers are getting access to the same zero-down products as everyone else.4. "My credit score isn't high enough"

A credit score is part of a person’s financial story, but not all of it. Each lender sets its own minimum credit score, so even if a potential homebuyer’s credit is less than perfect, they may still qualify for a mortgage. And today’s PMI has evolved far beyond a one-size-fits-all pricing model, with highly flexible, much more granular pricing structures taking into account considerably more than just a credit score.5. "Good things come to those who wait"

There are a host of reasons why waiting to purchase a home could actually hurt more in the long run. Interest rates, currently at around 3.97%—and down nearly 40% from their post-housing bubble high of 6.48% in 2008—are at historic lows, but there is little guarantee that they’ll stay there forever. Today’s flexible PMI is allowing potential first- and second-time homebuyers to put less down, freeing up money for improvements to fixer-uppers. Additionally, homeowners’ personal wealth is, on average, 46 times higher than that of renters.** That’s typically because mortgage payments, unlike rent payments, go toward building equity in real estate that would one day belong to the homeowner and potentially be available for future use.Conclusion

With rates at historic lows and programs for homebuyers with lower credit scores and less than 20% to put down, as well as the fact that purchasing a home can be a great way to build equity for a rainy day or retirement, now is the time to help Millennials break away from common misconceptions and myths by showing them how homeownership can be personally and financially beneficial today as well as in the future.

In short, the longer Millennials put off buying a home, the more money they may be throwing away on rent, the higher the price they may eventually pay to purchase a house, and the less opportunity they may have for increased financial flexibility and wealth later in life.

*Source: 2019 NAR Home Buyer and Seller Generational Trends Report

**Source: https://www.federalreserve.gov/econres/scfindex.htm

Millennials and Homeownership Infographic

Navigating the Spring Market: Tips for Buying or Selling Your Home

Spring is the busiest season in real estate, with warmer weather and blooming flowers highlighting a property's best features, and buyers prioritizing home tours before family obligations. Take a look at our checklists to help buyers and sellers prepare for the upcoming busy market.

Why Buying a Home Still Makes Sense in Today's Market: A 2025 Perspective

In today's real estate landscape, potential homebuyers might hesitate to enter the market. However, despite current challenges, several compelling reasons make homeownership an attractive option. With proper planning and understanding of available options, buying a home in 2025 can be a smart investment in your future.

Beyond the Rate Drop: Helping to Future-Proof Your Lending Strategy

The recent drop in interest rates may lead to an influx of purchase and refi volume for lenders. With this shift on the horizon, learn more about positioning yourself to meet customer needs and help borrowers at scale through proper use of technology and innovative solutions.

Homebuying Trends in the United States

Discover the state of homeownership in the US, including the significant disparities across racial and ethnic lines and the challenges that homebuyers face. Learn about the importance of addressing these disparities and creating more equitable pathways to homeownership for building wealth and ensuring accessibility for all.

Debunking 7 Common Mortgage Myths

The homebuying process can be exciting, but it can also be overwhelming, especially when it comes to mortgages. There's a lot of information out there, but not all of it is accurate. In this article, we debunk some common mortgage and PMI myths to help borrowers make better informed financial decisions.

Explore the Evolving Traits of First-Time Homebuyers

Our infographic explores the characteristics and behaviors of today's first-time homebuyers, who prioritize homeownership as an important part of the American Dream despite economic and societal changes.

Loan Officers' Social Media Checklist: Best Practices to Help Build Your Brand

Loan officers can benefit from social media to connect with potential borrowers, build their brand, and establish themselves as a reliable authority in the mortgage industry. Optimizing social media profiles and posting strategies can attract new business and create lasting relationships with borrowers and business professionals. Check out our checklists to get started!

The American Dream of Homeownership Starts with Financial Literacy

As we celebrate National Financial Literacy month this April, it’s a reminder of the important role that financial literacy plays in preparing for the homebuying journey. Learn more about financial literacy for homebuyers.

4 Simple Steps for Loan Officers to Build Lasting Relationships in 2024

Using these 4 Simple Steps, Loan Officers can help their elevate business and redefine success in 2024 by building strong relationships with real estate agents, prior clients, local community organizations, and other trusted service providers.

The Millennial and Gen Z Homebuyer

Recognizing and understanding behaviors of Millennial and Gen Z homebuyers can empower loan officers and real estate agents to engage these distinct generations of homebuyers.